2023

advisory services

simplified cost options

simplification

interactive innovation

operational groups

The extreme heterogeneity and variability of agricultural advisory services and fees of the advisors is a challenging aspect for the Managing Authorities who support interventions relating to their use and provision. Financing even small-scale projects often requires burdensome technical and administrative activities, involving numerous human resources and a large volume of documents to be verified for each application. Moreover, the administrative burdens might be a deterrent also for, especially individual, advisors to apply to CAP for the provision of advisory services.

However, this type of intervention is extremely relevant to improve the farming practices and performances of the farmers towards more sustainable and competitive agriculture. The following issues were encountered in delivering and accessing to interventions relating to the use and setting up of advisory services:

The use of Simplified Cost Options (SCO) is considered to be highly effective in reducing administrative burden and error rates. To this end the National Rural network (NRN), through a guideline document, provided the methodology for the determination of a standard unit cost (SUC) to apply to M2 of the RDPs 2014-2022 for those categories of advisory providers that most significantly cover the CAP topics: agronomist, land surveyor, agrotechnicians and veterinarians (only animal husbandry). The latter categories were identified by considering the experts' opinion and the information collected over the use/provision of farm advisory services applied under the RDPs 2007- 2013 (M114).

The overall methodology for the determination of the SUC was concerted among some thematic experts of the NRN (i.e. experts on simplified costs, farm advisory services), 5 representatives of the MAs of the RDPs and 16 advisory organizations of across Italy. All in all, it was decided to determine one hourly SUC with the view to cover both, the fees and the possible costs being occurred for the provision of advisory services (for field visits and for equipment).

The list of the documentation to provide for the probation of the effective provision of the planned farm advisory services includes:

During the programming period 2014-2020, this solution was adopted for 28 out of 361 (78%) calls for applications on advisory services (Measure 2.1), so that the standard unit cost was applied to about 18.200 beneficiaries under Measure 2.1 of 17 Italian RDPs 2014-20202.

A mix of methods, tools and sources of information were applied to collect and validate relevant information: (a) desk research on official statistical data; (b) surveys to public servants that were responsible for M2 of the RDPs and to 340 advisors to collect experts’ opinions, data and information and to validate the consistency of the results of the calculations/official statistics.

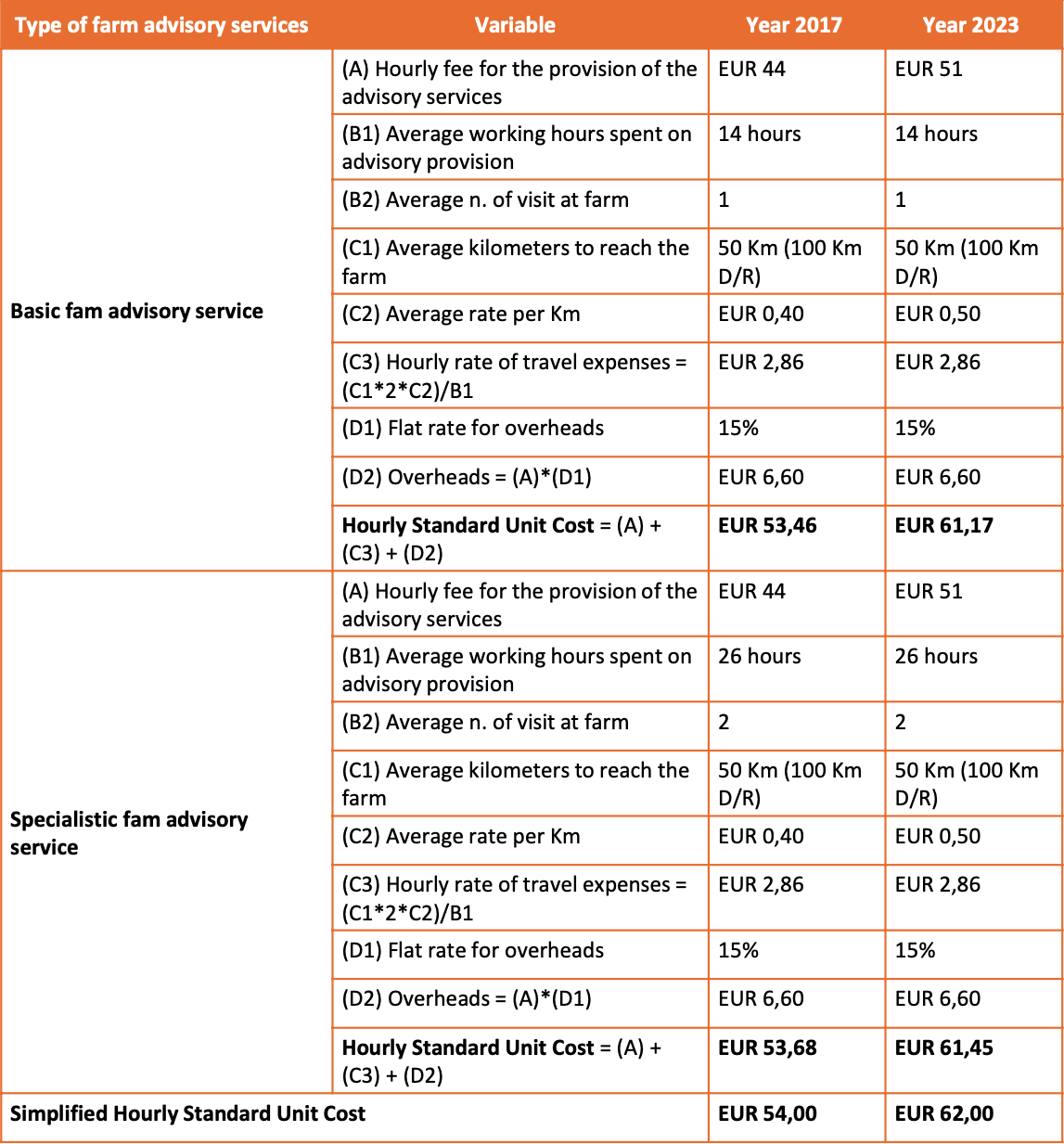

The variables were determined as it follows:

A. Hourly standard fee of the advisory services’ provision.

This is determined by considering the diversity in types of advisory services (box 1), of advisory methods (es. Individual/in-group), of typologies of advisory organizations (freelance or associated advisory body). In practice, the average hourly standard fee3 of advisors, that is equal to EUR 44,00, is drawn from the statistical data of income sector studies provided by the national revenue agency. This reflects the average remuneration of the abovementioned categories of farm advisory providers by the year of the guideline document of the NRN (2018; 2023).

B. Working hours needed for the provision of the advisory ser

vices.

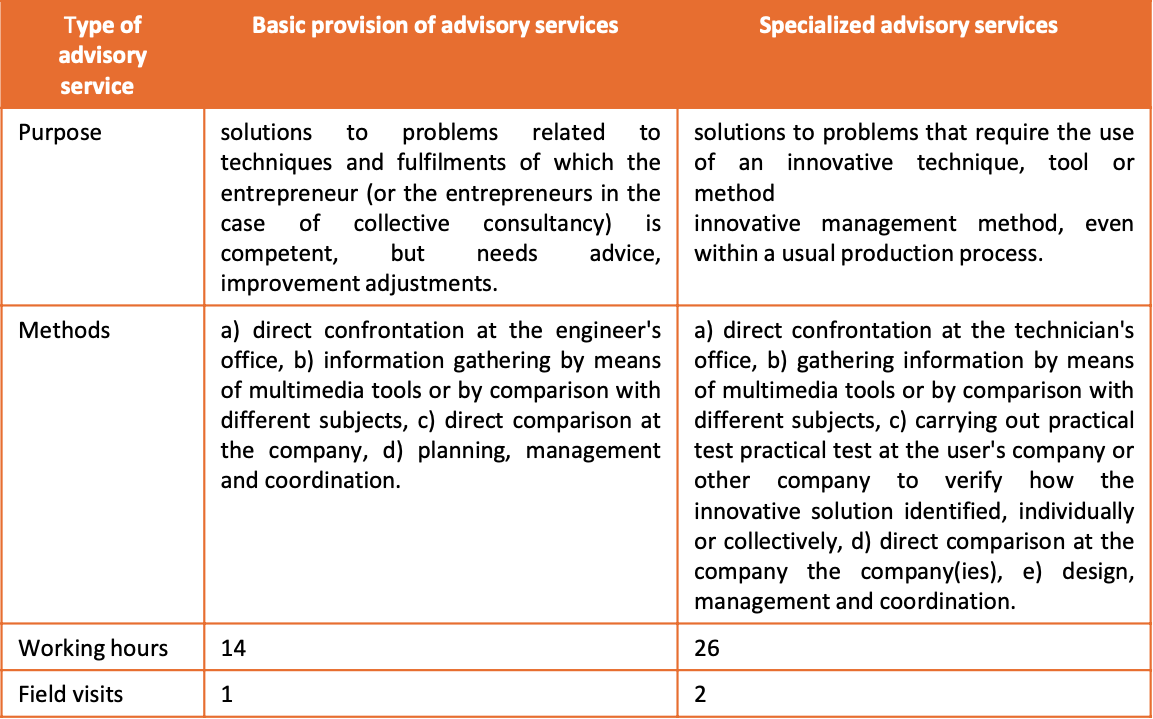

On this regards, two main types of advisory services normally provided under the CAP were distinguished as they have different implications in terms of commitment by the advisors. (table 1).

Table 1: Types of advisory services applied under the RDPs 2007-2013 (M114)

C. Travel costs for field visits and meetings with clients

In order to recognize a refund for travels these category of costs are based on a mileage refund, so that the SUC is determined just to cover the average cost occurred by the advisor to reach the farm by car, as it follows: (i) the average distance from office to clients that, based on advisors’ opinions, was determined as equal to 50 Km per field visit and, (ii) the average rate of refunding per kilometre (Km), that it is established on annual basis by the Ministry of Transport and it was determined as equal to EUR 0,40 (2017; updated to 0,50 in 2023).

D. Overheads to cover indirect expenses relating, for example, to equipment (e.g. tests, meeting room renting, telephone bills).

By referring to art. 68, 1.b) of the EU reg. 1303/2013, overheads are fixed on a flat rate equal to 15% of the direct eligible personnel costs, that, by assumption for the purpose of the SUC, are represented by the hourly standard fee (A).

Based on the identification of the abovementioned variables, the SUC for the two types of advisory services are calculated as it is showed in boxes 1 and 2.

Table 2: Determination of Standard Unit Costs

In practice, for simplification, only one SUC was determined as reference for the provision of both types of advisory services provided under the RDPs 2014-2020 in Italy (EUR 54,00 at 2018; EUR 62,00 at 2023).

So calculated, the SUC represents and all-inclusive hourly fee that, as multiplied by the n. of hours actually spent for the provision of one advisory service, determines the global remuneration to refund to the advisor.

The use of standard costs under the CAP Regulation 2023-2027 has been furtherly simplified. However, some administrative arrangements still remain relevant: